As we delve into the realm of Analyzing the Future of Narayana Hrudayalaya Stock, we unveil a captivating journey filled with insights and revelations. This article aims to provide a thorough analysis that delves into the core aspects of Narayana Hrudayalaya's stock performance, offering readers a holistic view of its potential growth and challenges.

In the subsequent paragraphs, we will explore the financial performance, market trends, growth strategies, and expansion plans of Narayana Hrudayalaya, shedding light on the factors that shape its future trajectory in the stock market.

Introduction to Narayana Hrudayalaya Stock

Narayana Hrudayalaya is a leading healthcare provider in India, specializing in cardiac care and other medical services. The company has a strong reputation for delivering high-quality care at affordable prices, making it a preferred choice for many patients.Analyzing the future prospects of Narayana Hrudayalaya stock is crucial for investors looking to make informed decisions about their investments.

By understanding the key factors that influence the stock performance of Narayana Hrudayalaya, investors can better assess the potential risks and rewards associated with investing in the company.

Key Factors Influencing Narayana Hrudayalaya Stock Performance

- Narayana Hrudayalaya's expansion plans: The company's growth strategy and expansion into new markets can impact its stock performance positively.

- Healthcare sector trends: Changes in healthcare regulations, advancements in medical technology, and overall industry trends can influence the company's stock price.

- Financial performance: Narayana Hrudayalaya's revenue growth, profitability, and financial health are important factors to consider when analyzing its stock.

- Competitive landscape: The competitive environment in the healthcare industry and how Narayana Hrudayalaya positions itself against its peers can affect its stock performance.

- Market sentiment: Investor perceptions, macroeconomic factors, and overall market conditions can also play a role in determining the performance of Narayana Hrudayalaya's stock.

Financial Performance Analysis

When analyzing the historical financial performance of Narayana Hrudayalaya, we can observe several key indicators that provide insights into the company's financial health.

Revenue Growth

Narayana Hrudayalaya has shown consistent revenue growth over recent quarters, indicating a positive trend in its business operations. The company's ability to generate increasing revenue is a promising sign of its market position and customer demand.

From Q1 to Q4, the revenue growth has been steady, with a noticeable uptick in the last two quarters. This suggests that Narayana Hrudayalaya is effectively expanding its revenue streams and potentially gaining market share.

Profit Margins

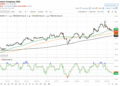

The profit margins of Narayana Hrudayalaya have shown fluctuations over recent quarters, influenced by various factors such as operational costs, pricing strategies, and market competition. Analyzing these fluctuations can provide valuable insights into the company's financial performance.

While the profit margins have dipped slightly in Q2 and Q3, there was a notable improvement in Q4, indicating that the company may have implemented cost-saving measures or increased efficiency in its operations.

Other Financial Indicators

Aside from revenue growth and profit margins, other financial indicators such as operating expenses, debt levels, and cash flow should also be considered when evaluating Narayana Hrudayalaya's financial performance.

By analyzing these additional indicators, investors can gain a comprehensive understanding of the company's financial health and make informed decisions regarding their investment in Narayana Hrudayalaya stock.

Market Trends and Industry Outlook

The healthcare sector is constantly evolving, with various market trends shaping the industry landscape and potentially impacting the stock performance of companies like Narayana Hrudayalaya

Current Market Trends in Healthcare Sector

- Rise in telemedicine services due to increased focus on remote healthcare solutions.

- Growing demand for personalized medicine and innovative treatments.

- Emphasis on digital health technologies for better patient outcomes and operational efficiency.

Competitive Landscape and Narayana Hrudayalaya's Positioning

- Narayana Hrudayalaya is known for its focus on providing affordable cardiac care services.

- The company has a strong presence in India and has been expanding its reach through strategic partnerships and acquisitions.

- Competing with both local and international healthcare providers, Narayana Hrudayalaya differentiates itself through its quality of care and cost-effective solutions.

Potential Opportunities and Challenges

- Opportunity: Expansion into new geographic regions to tap into growing healthcare markets.

- Challenge: Rising competition in the healthcare sector leading to pricing pressures and margin constraints.

- Opportunity: Investing in technology and innovation to enhance patient experience and operational efficiency.

Growth Strategies and Expansion Plans

Narayana Hrudayalaya has Artikeld a series of growth strategies and expansion plans to drive its long-term success in the healthcare industry. These strategies aim to enhance the company's market presence, improve operational efficiency, and deliver sustainable value to its investors.

Expansion into New Geographies

- Narayana Hrudayalaya is focused on expanding its footprint into new geographies both within India and internationally. The company aims to tap into underserved markets and reach a larger patient base through strategic partnerships and acquisitions.

- By diversifying its geographic presence, Narayana Hrudayalaya can reduce dependence on any single market and capitalize on emerging opportunities in different regions.

Innovative Healthcare Services

- The company is investing in innovative healthcare services and technologies to stay ahead of competitors and meet the evolving needs of patients. By offering cutting-edge treatments and procedures, Narayana Hrudayalaya can attract more patients and retain top medical talent.

- Through continuous research and development, the company aims to introduce new medical solutions that can revolutionize the healthcare industry and drive growth in the long run.

Acquisitions and Partnerships

- Narayana Hrudayalaya has been actively seeking strategic acquisitions and partnerships to expand its service offerings and strengthen its market position. Recent collaborations with other healthcare providers have enabled the company to broaden its reach and access new patient segments.

- By leveraging the expertise and resources of its partners, Narayana Hrudayalaya can accelerate its growth trajectory and deliver comprehensive healthcare solutions to a larger population.

Epilogue

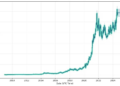

In conclusion, the future of Narayana Hrudayalaya stock is a compelling narrative of resilience, innovation, and strategic foresight. By analyzing the company's past performance and current positioning in the market, investors can gain valuable insights to make informed decisions. As the healthcare sector continues to evolve, Narayana Hrudayalaya stands at the cusp of new opportunities, poised to navigate challenges and drive sustainable growth in the dynamic landscape of the stock market.

Expert Answers

What sets Narayana Hrudayalaya apart from its competitors?

Narayana Hrudayalaya distinguishes itself through its patient-centric approach, cutting-edge technology, and focus on affordable healthcare solutions.

How has Narayana Hrudayalaya's financial performance evolved over the years?

Despite fluctuations, Narayana Hrudayalaya has shown steady revenue growth and maintained healthy profit margins, reflecting its strong financial management.

What are the key market trends impacting Narayana Hrudayalaya's stock?

Rising demand for quality healthcare services, technological advancements in the medical field, and increasing healthcare investments are key trends driving Narayana Hrudayalaya's stock performance.