Kicking off with Deepak Nitrite Share: Should You Invest Now or Wait?, this opening paragraph is designed to captivate and engage the readers, providing an interesting overview of the topic.

Deepak Nitrite is a company that has been making waves in the market. From recent trends in share prices to its intriguing history, there's a lot to consider when deciding whether to invest now or wait.

Overview of Deepak Nitrite Shares

Deepak Nitrite is a well-established chemical manufacturing company that has been making its mark in the market for several years. Known for its quality products and innovation, Deepak Nitrite has gained a strong foothold in the industry.

Current Position of Deepak Nitrite in the Market

Deepak Nitrite has been performing well in the market, with its shares showing a steady increase in value. The company's strong financial performance and strategic investments have contributed to its positive position in the market.

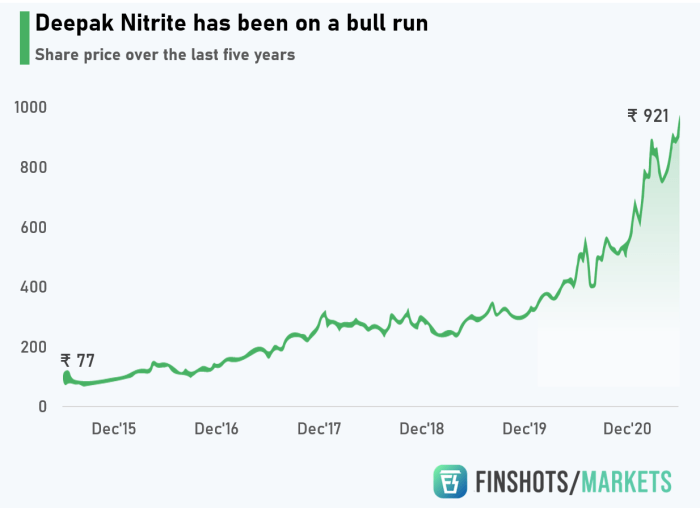

Recent Trends in Deepak Nitrite Share Prices

In recent times, Deepak Nitrite share prices have been on an upward trend, reflecting the confidence of investors in the company. The consistent growth in share prices indicates a positive outlook for the company's future prospects.

Brief History of Deepak Nitrite

Established in 1970, Deepak Nitrite has grown to become a leading player in the chemical industry. The company has a strong legacy of innovation and excellence, which has helped it carve a niche for itself in the market.

Factors Influencing Deepak Nitrite Share Prices

When it comes to investing in Deepak Nitrite shares, it's essential to understand the key factors that influence their prices. Market trends, company performance, and various other external factors can have a significant impact on the value of these shares.

Market Trends

Market trends play a crucial role in determining the value of Deepak Nitrite shares. Positive trends in the chemical industry, changes in demand for specific products, and global economic conditions can all affect the share prices. For example, if there is a sudden increase in demand for a particular chemical product that Deepak Nitrite specializes in, the share prices are likely to rise.

Company Performance

The performance of Deepak Nitrite as a company directly correlates with the value of its shares. Factors such as revenue growth, profit margins, expansion into new markets, and product innovation can impact the share prices. Investors closely monitor the financial reports and announcements made by the company to gauge its performance and make informed decisions about buying or selling shares.

External Factors

External factors such as government regulations, competition in the industry, changes in raw material prices, and geopolitical events can also influence Deepak Nitrite share prices. For instance, if there is a new regulation that affects the production process of the company, it could impact the share prices negatively.Overall, investors looking to invest in Deepak Nitrite shares should keep a close eye on these factors to make informed decisions and navigate the dynamic stock market effectively.

Investment Potential of Deepak Nitrite Shares

Investing in Deepak Nitrite shares presents significant growth potential for investors looking to capitalize on the company's performance in the chemical sector. With a strong market presence and a track record of consistent growth, Deepak Nitrite shares have become an attractive option for those seeking long-term investment opportunities.

Comparison with Other Companies in the Same Sector

When compared to other companies in the chemical sector, Deepak Nitrite stands out due to its diversified product portfolio, robust financial performance, and strong market position. The company's focus on innovation and sustainability has enabled it to outperform competitors and maintain a competitive edge in the industry.

- Deepak Nitrite's revenue growth has consistently outpaced industry averages, showcasing its ability to generate value for shareholders.

- The company's strategic investments in research and development have led to the introduction of new products and technologies, further enhancing its market position.

- Compared to its peers, Deepak Nitrite has demonstrated resilience during economic downturns, making it a reliable investment option for risk-averse investors.

Upcoming Projects and Expansions

Deepak Nitrite's upcoming projects and expansions are expected to have a positive impact on its share prices, further fueling investor interest in the company. The company's plans for capacity expansion, new product launches, and strategic partnerships are poised to drive growth and enhance shareholder value in the coming years.

Investors should closely monitor Deepak Nitrite's developments and performance indicators to capitalize on potential opportunities and maximize returns on their investment.

Risks Associated with Investing in Deepak Nitrite Shares

Investing in Deepak Nitrite shares comes with certain risks that potential investors should be aware of. These risks can impact the performance of the shares and the overall investment.

Market Volatility

Market volatility can have a significant impact on the price of Deepak Nitrite shares. Fluctuations in the stock market can lead to sudden and drastic changes in share prices, affecting the value of your investment. It is essential to monitor market trends closely and be prepared for potential price swings.

Regulatory Changes

Changes in regulations, especially in the chemical industry where Deepak Nitrite operates, can pose a risk to the company's operations and financial performance. New regulations or government policies could impact production processes, increase compliance costs, or restrict certain activities, ultimately affecting the share prices.

Staying informed about regulatory developments is crucial for investors.

Competition and Industry Trends

Competitive pressures and industry trends can also impact Deepak Nitrite shares. Increased competition in the chemical sector or changes in consumer preferences can affect the company's market position and profitability. It is important to assess the competitive landscape and industry trends to evaluate the potential risks to your investment.

Currency Fluctuations

Deepak Nitrite operates in a global market, which exposes it to currency fluctuations. Changes in exchange rates can impact the company's revenues and profitability, affecting the share prices. Investors should consider the potential impact of currency movements on their investment in Deepak Nitrite shares.

Mitigating Risks

To mitigate the risks associated with investing in Deepak Nitrite shares, diversification is key. By spreading your investment across different asset classes or industries, you can reduce the impact of any single risk factor on your overall portfolio. Additionally, staying informed about market developments, company news, and industry trends can help you make well-informed investment decisions and mitigate potential risks.

Final Thoughts

In conclusion, the decision to invest in Deepak Nitrite shares requires careful consideration of various factors. Whether you choose to jump in now or hold off for a while, understanding the market dynamics and company performance is key. Stay informed and make a well-informed decision for your investment portfolio.

Key Questions Answered

Should I invest in Deepak Nitrite shares right now?

The decision to invest in Deepak Nitrite shares depends on your risk tolerance and investment goals. Consider factors like market trends and company performance before making a decision.

What are the risks associated with investing in Deepak Nitrite shares?

Potential risks include market fluctuations, industry competition, and external factors affecting share prices. It's important to conduct thorough research and consider diversification to mitigate these risks.