Exploring the world of Deepak Nitrite Share Forecast for Long-Term Investors, this piece unveils a captivating journey filled with valuable insights and projections. Get ready to dive deep into the intricacies of this investment opportunity.

Providing a comprehensive look at the company's background, products, financial performance, and the factors influencing its share forecast, this discussion aims to equip investors with the knowledge needed to make informed decisions.

Overview of Deepak Nitrite Company

Deepak Nitrite is a leading chemical manufacturing company in India, with a history dating back to 1970. The company has established a strong reputation for producing a diverse range of chemicals used in various industries.

Key Products and Services

- Specialty Chemicals: Deepak Nitrite produces specialty chemicals such as phenol, acetone, and various intermediates used in agrochemicals, pharmaceuticals, and rubber industries.

- Basic Chemicals: The company also manufactures basic chemicals like organic and inorganic chemicals used in the production of dyes, pigments, and plastics.

- Fine and Performance Chemicals: Deepak Nitrite offers a range of fine and performance chemicals catering to the needs of the agriculture, pharmaceutical, and personal care sectors.

Financial Performance

Deepak Nitrite has shown consistent growth in its financial performance over the recent years. The company has reported an increase in revenue and profits, supported by its diversified product portfolio and strong customer base. With a focus on innovation and sustainability, Deepak Nitrite is well-positioned for continued success in the chemical industry.

Factors Influencing Deepak Nitrite Share Forecast

Investing in Deepak Nitrite shares requires a thorough understanding of the various market factors, industry trends, and global economic conditions that can influence the company's performance and share price.

Market Factors Impacting Deepak Nitrite

- Raw Material Prices: Fluctuations in the prices of raw materials like phenol, acetone, and benzene can significantly impact Deepak Nitrite's production costs and profitability.

- Competition: Intense competition in the chemical industry can affect Deepak Nitrite's market share and pricing strategy.

- Demand for Specialty Chemicals: The demand for specialty chemicals, in which Deepak Nitrite specializes, plays a crucial role in determining the company's growth prospects.

Industry Trends Affecting Performance

- Regulatory Environment: Changes in regulations related to environmental norms, safety standards, or trade policies can have a direct impact on Deepak Nitrite's operations and financial results.

- Technological Advancements: Innovations in chemical processes and technologies can enhance Deepak Nitrite's competitive edge or pose a threat if the company fails to adapt.

Global Economic Conditions and Share Forecast

- Geopolitical Events: Political instability, trade wars, or economic sanctions in key regions can disrupt global supply chains and demand for chemicals, affecting Deepak Nitrite's export markets.

- Currency Fluctuations: Changes in exchange rates can impact Deepak Nitrite's export competitiveness and profitability, especially if a significant portion of its revenue is generated in foreign currencies.

Long-Term Investment Potential of Deepak Nitrite Shares

Investing in Deepak Nitrite shares for the long term can be a lucrative opportunity for investors looking for sustained growth in their portfolio. The company has shown strong performance and has the potential to continue on this trajectory in the future.

Growth Prospects of Deepak Nitrite

- Deepak Nitrite has been consistently expanding its product portfolio and market reach, which bodes well for its long-term growth potential.

- The company's focus on innovation and technology-driven solutions positions it well to capitalize on emerging trends in the industry.

- With increasing demand for specialty chemicals globally, Deepak Nitrite is well-positioned to benefit from this growth opportunity.

Comparison with Competitors

- When compared to its competitors in the industry, Deepak Nitrite has demonstrated strong financial performance and operational efficiency.

- The company's strategic investments in research and development give it a competitive edge over its peers.

- Deepak Nitrite's strong customer relationships and distribution network provide a solid foundation for sustained growth in the long run.

Unique Strengths and Weaknesses

- One of Deepak Nitrite's unique strengths is its diversified product portfolio, which reduces dependency on any single product segment.

- However, the company may face challenges related to raw material prices and regulatory changes, impacting its long-term value.

- Overall, Deepak Nitrite's strong fundamentals, market positioning, and growth initiatives make it an attractive long-term investment option.

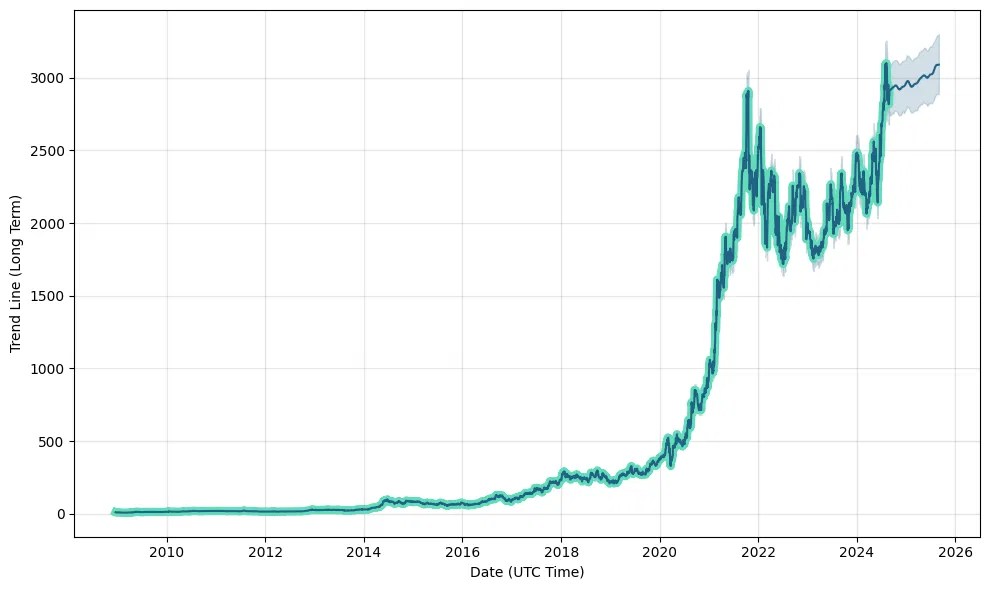

Analyst Recommendations and Forecasts

Analysts play a crucial role in providing insights and recommendations for investors looking to make informed decisions in the stock market. Let's delve into the recent recommendations and forecasts for Deepak Nitrite shares.

Recent Analyst Recommendations

Analysts covering Deepak Nitrite shares have provided a range of recommendations based on their research and analysis. These recommendations can influence investor sentiment and market trends.

- One analyst has recommended a "Buy" rating for Deepak Nitrite shares, citing strong financial performance and growth prospects.

- Another analyst has suggested a "Hold" rating, emphasizing the need for further evaluation of market conditions and industry trends.

- A third analyst has issued a "Sell" rating, raising concerns about potential risks and uncertainties in the company's operations.

Rationale Behind Recommendations

Analysts base their recommendations on a variety of factors, including company performance, industry trends, market conditions, and macroeconomic indicators. The rationale behind these recommendations provides valuable insights for investors.

- The "Buy" rating may be supported by strong revenue growth, expanding market share, and positive industry outlook.

- The "Hold" rating could be influenced by concerns about valuation, competitive pressures, or regulatory challenges.

- The "Sell" rating might stem from issues like declining profitability, high debt levels, or adverse market conditions.

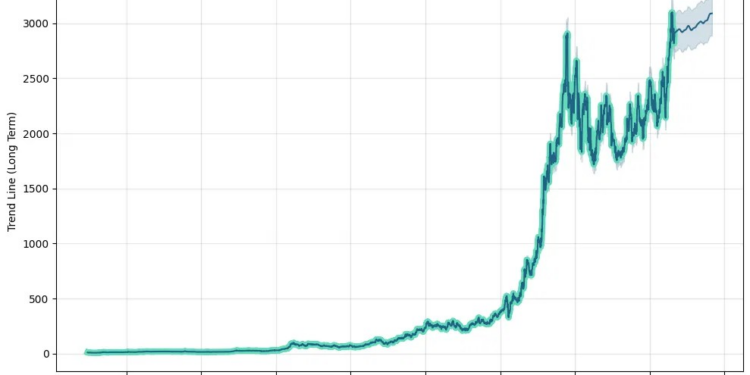

Range of Forecasts

Analysts also provide forecasts for Deepak Nitrite shares, predicting potential price targets and performance indicators over a specified period. These forecasts can guide investors in setting expectations and making strategic decisions.

- Forecasts for Deepak Nitrite shares range from bullish predictions of significant price appreciation to bearish outlooks anticipating a decline in value.

- The range of forecasts reflects varying opinions and perspectives on the company's future prospects, highlighting the uncertainty and complexity of stock market dynamics.

Conclusive Thoughts

In conclusion, Deepak Nitrite emerges as a promising prospect for long-term investors, backed by strong growth potential and unique market positioning. As you navigate the realm of investment opportunities, keep an eye on the forecasts and recommendations surrounding Deepak Nitrite shares for a well-rounded approach to maximizing returns.

FAQ Overview

What are some key products and services offered by Deepak Nitrite?

Deepak Nitrite offers a range of products including basic chemicals, fine and specialty chemicals, and performance products.

How do global economic conditions impact Deepak Nitrite's share forecast?

Global economic conditions can influence factors such as demand, prices of raw materials, and market dynamics, all of which can impact Deepak Nitrite's share forecast.