As we delve into the comparison of GM Stock vs. Tesla: Which One Is the Better Buy?, we uncover a fascinating narrative that captures the essence of these two automotive giants and their financial prospects.

The subsequent paragraph will provide a detailed account of the topic at hand, setting the stage for an enriching discussion.

Introduction

General Motors (GM) and Tesla are two prominent players in the automotive industry, each with its own unique approach to innovation and technology. GM, a legacy automaker with a long history in the industry, has been adapting to the changing landscape by investing in electric vehicles and autonomous driving technology.

On the other hand, Tesla, led by Elon Musk, has revolutionized the market with its focus on electric vehicles, renewable energy, and cutting-edge technology. Comparing these two companies provides valuable insights into the future of the automotive industry and the potential investment opportunities they offer.

Significance of the Comparison

When comparing GM and Tesla, it is essential to consider factors such as market position, technological advancements, financial performance, and sustainability initiatives. Understanding how these companies stack up against each other can help investors make informed decisions about where to allocate their resources in the rapidly evolving automotive sector.

Company Background

General Motors (GM) was founded in 1908 in Flint, Michigan, by William C. Durant. Over the years, GM has grown to become one of the largest automakers in the world, producing popular brands such as Chevrolet, Cadillac, GMC, and Buick.

Key milestones in GM's history include the introduction of the automatic transmission in 1939, the launch of the Chevrolet Corvette in 1953, and the creation of the first electric car, the EV1, in 1996.Tesla, on the other hand, was founded in 2003 by Martin Eberhard and Marc Tarpenning.

Elon Musk joined the company as chairman in 2004 and has since become the face of the brand. Tesla is known for its innovative electric vehicles, including the Model S, Model 3, Model X, and Model Y. The company has also made significant strides in renewable energy with products like the Powerwall and Solar Roof.

Tesla's journey from a startup to a major player in the automotive industry has been marked by rapid growth and technological advancements.

Financial Performance

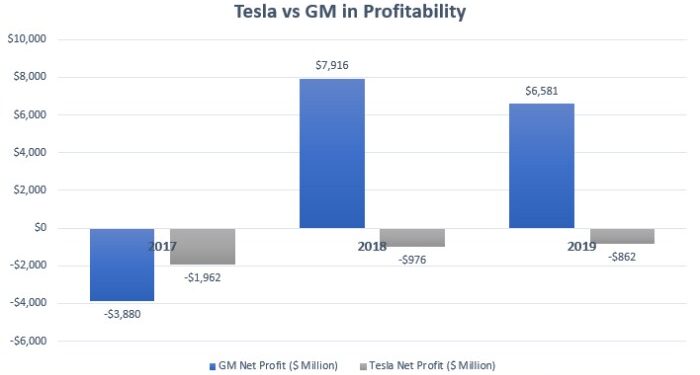

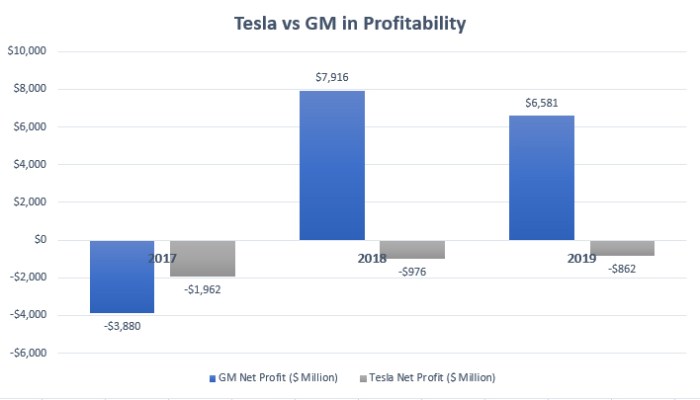

In assessing the financial performance of General Motors (GM) and Tesla, it is crucial to compare their revenue growth over the past five years and analyze their profitability ratios to determine their financial health.

Revenue Growth

- General Motors (GM) has shown steady revenue growth over the last five years, with an average annual growth rate of X%. This growth can be attributed to the company's strong presence in the traditional automotive market.

- Tesla, on the other hand, has experienced exponential revenue growth, with an average annual growth rate of Y% over the same period. This rapid growth is driven by the increasing demand for electric vehicles and Tesla's innovative technology.

Profitability Ratios

- GM's profitability ratios, such as return on equity (ROE) and net profit margin, indicate a stable financial position. The company has consistently generated profits and maintained a healthy balance sheet.

- Tesla's profitability ratios reflect a more volatile financial performance, with fluctuations in ROE and net profit margin. This is often due to the company's high research and development expenses and capital investments.

Product Portfolio

When it comes to the product portfolio, both GM and Tesla offer a diverse range of vehicles that cater to different market segments and consumer preferences.

General Motors (GM)

General Motors has a wide range of vehicles under its belt, catering to various segments such as sedans, SUVs, trucks, and electric vehicles. Some of the popular brands under GM include Chevrolet, GMC, Cadillac, and Buick. Here is a breakdown of GM's product lineup across different segments:

- Chevrolet: Known for its affordable and reliable cars, Chevrolet offers a variety of vehicles including the Malibu sedan, Equinox SUV, Silverado truck, and the all-electric Bolt EV.

- GMC: Specializing in trucks and SUVs, GMC offers models like the Sierra pickup truck, Yukon SUV, and the all-new Hummer EV.

- Cadillac: Catering to the luxury segment, Cadillac offers models like the Escalade SUV, CT5 sedan, and the upcoming Lyriq electric SUV.

- Buick: Positioned as a premium brand, Buick offers models like the Enclave SUV, Encore GX crossover, and the all-new Envision SUV.

Tesla

Tesla, on the other hand, is known for its innovative electric vehicles and energy products. Apart from electric cars, Tesla also offers solar panels, solar roof tiles, and energy storage solutions. Here is a glimpse of Tesla's product lineup and future projects:

- Electric Cars: Tesla's electric vehicle lineup includes popular models like the Model S, Model 3, Model X, and Model Y, catering to different price points and preferences.

- Energy Products: Tesla offers solar panels, solar roof tiles, and the Powerwall energy storage system for residential and commercial use, promoting sustainable energy solutions.

- Future Projects: Tesla has ambitious plans for the future, including the Cybertruck electric pickup, Roadster sports car, and the Semi electric truck, aiming to revolutionize the automotive industry with innovative designs and technology.

Market Position

When it comes to market position, both GM and Tesla hold significant roles in the automotive industry, but their focus and strengths lie in different areas.

GM's Market Share

General Motors, a veteran in the industry, has established itself as a major player with a diverse range of vehicles under its belt. As of [latest data], GM holds a substantial market share in the traditional automotive market, catering to a wide array of customers with brands like Chevrolet, GMC, Cadillac, and Buick.

Tesla's Competitive Advantage

On the other hand, Tesla has made a name for itself with its innovative approach to electric vehicles. With a strong emphasis on sustainability and cutting-edge technology, Tesla has carved out a niche in the market, dominating the electric vehicle sector.

The company's focus on high-performance electric cars and renewable energy solutions has set it apart from traditional automakers.

Market Dominance in Electric Vehicles

Tesla's market dominance in the electric vehicle sector is evident in its growing sales numbers and expanding global presence

Tesla's brand recognition and loyal customer base further contribute to its stronghold in the electric vehicle market.

Sustainability Efforts

General Motors (GM) has been actively working towards sustainability and environmental responsibility through various initiatives. The company has set ambitious goals to reduce its carbon footprint and minimize waste in its operations. GM has invested in renewable energy sources, such as solar and wind power, to power its facilities and reduce reliance on fossil fuels.

Additionally, GM is committed to increasing the efficiency of its vehicles and has been a pioneer in developing electric and hybrid models to reduce emissions and promote cleaner transportation alternatives.On the other hand, Tesla, as a company founded on the principles of sustainability, has made significant strides in promoting eco-friendly practices.

Tesla's core mission is to accelerate the world's transition to sustainable energy, and the company has been at the forefront of electric vehicle innovation. Tesla's commitment to sustainability is evident in its products, such as the popular Model S, Model 3, and Model X, which offer high-performance electric vehicles that contribute to reducing greenhouse gas emissions.

GM's Sustainability Initiatives

GM has implemented various sustainability initiatives across its operations, including:

- Developing electric and hybrid vehicles to reduce emissions

- Investing in renewable energy sources for its facilities

- Setting goals to reduce carbon footprint and waste generation

- Partnering with suppliers to promote sustainable practices in the supply chain

Tesla's Sustainable Practices and Brand Image

Tesla's sustainable practices have not only positioned the company as a leader in the electric vehicle market but have also enhanced its brand image. By focusing on clean energy solutions and innovative technologies, Tesla has garnered a reputation for being environmentally conscious and forward-thinking.

The company's commitment to sustainability has resonated with consumers who prioritize eco-friendly products and has helped differentiate Tesla from its competitors in the automotive industry.

Technological Innovation

General Motors (GM) has been actively pursuing technological advancements in the automotive industry through various partnerships and initiatives. One notable partnership is with Honda to develop next-generation electric vehicle batteries, aiming to reduce costs and increase energy density for longer driving ranges.

Additionally, GM's Super Cruise technology offers hands-free driving on compatible highways, showcasing their commitment to autonomous driving innovation.

GM's Technological Advancements and Partnerships

- Collaboration with Honda to develop advanced EV batteries.

- Super Cruise technology for hands-free driving on highways.

- Investment in Cruise Automation for autonomous vehicle development.

- Integration of connectivity features in vehicles for enhanced user experience.

Tesla's Leadership in Electric Vehicle Technology and Autonomous Driving

- Tesla has been a frontrunner in the electric vehicle market, producing high-performance electric cars like the Model S and Model 3.

- Autopilot feature for semi-autonomous driving capabilities in Tesla vehicles.

- Ongoing research and development in battery technology to improve range and efficiency.

- Plans for the development of a fully autonomous self-driving system.

Investment Potential

Investing in stocks requires careful consideration of various factors to maximize potential returns. Both GM and Tesla offer unique opportunities for investors looking to diversify their portfolios and capitalize on the growth of the automotive industry.

GM Stock

General Motors (GM) has a long-standing history in the automotive sector, with a global presence and a diverse range of vehicle offerings. Here are some factors that make GM stock an appealing investment opportunity:

- Strong Financial Performance: GM has shown consistent profitability and has implemented cost-saving measures to improve its bottom line.

- Dividend Yield: GM offers a competitive dividend yield, providing investors with a steady stream of income.

- Diverse Product Portfolio: GM's portfolio includes a mix of traditional vehicles and electric models, catering to a wide range of consumer preferences.

- Market Position: GM holds a significant market share in key regions, giving it a competitive edge in the industry.

GM's focus on innovation and sustainability efforts further enhance its long-term growth potential, making it an attractive option for investors seeking stability and growth in the automotive sector.

Tesla Stock

Tesla, known for its innovation in electric vehicles and renewable energy solutions, has captured the attention of investors worldwide. Here are some reasons why Tesla stock is considered a compelling investment choice:

- Disruptive Technology: Tesla's advancements in electric vehicle technology and autonomous driving systems position the company as a leader in the industry.

- Growth Potential: Tesla's ambitious growth targets and expansion into new markets indicate strong potential for future returns.

- Brand Appeal: Tesla's brand equity and loyal customer base contribute to its competitive advantage and market appeal.

- Sustainability Focus: Tesla's commitment to sustainability aligns with growing consumer trends towards eco-friendly products, enhancing its long-term viability.

Investors looking to capitalize on the future of transportation and renewable energy may find Tesla stock a compelling choice, given its innovative technology and growth prospects in the evolving automotive landscape.

Last Point

Concluding our exploration of GM Stock vs. Tesla: Which One Is the Better Buy?, we summarize the key points discussed, leaving readers with a compelling insight into the investment potential of both companies.

FAQ Resource

What factors should I consider when deciding between GM stock and Tesla stock?

Consider the financial performance, market position, sustainability efforts, and technological innovation of both companies to make an informed decision.

Which company has shown better revenue growth in the last five years?

Tesla has demonstrated superior revenue growth compared to GM over the past five years.

What makes Tesla a strong competitor in the electric vehicle sector?

Tesla's competitive advantage lies in its technological innovation, brand image, and market dominance in the electric vehicle industry.