Starting off with a focus on What Makes JEPI ETF a Top Pick for Conservative Investors?, this introductory paragraph aims to draw in the audience with a mix of informative and engaging content.

The following paragraph will delve deeper into the specifics of the topic, providing a comprehensive overview.

Introduction to JEPI ETF

JEPI ETF, short for JPMorgan Equity Premium Income ETF, is a popular investment option known for its stability and income-generating potential in the financial market.

Significance of JEPI ETF

JEPI ETF was launched in 2016 by J.P. Morgan Asset Management and has since gained recognition for its unique approach to providing investors with exposure to the equity markets while offering an income component.

Key Features and Characteristics

- JEPI ETF aims to track the performance of the S&P 500 Index while utilizing a covered call strategy to generate income.

- Investors benefit from potential downside protection due to the premium income generated from writing covered calls on the underlying stocks.

- The ETF offers a competitive dividend yield compared to traditional equity investments, making it attractive for conservative investors seeking income.

- JEPI ETF has shown resilience during market downturns, providing a level of stability that appeals to risk-averse investors.

Conservative Investment Strategies

Conservative investment strategies are approaches that prioritize capital preservation and lower risk exposure. These strategies are crucial for risk-averse investors who prioritize protecting their investments over seeking high returns. By focusing on stable and established assets, conservative investors aim to minimize the potential for significant losses in their portfolios.

Benefits of Conservative Investment Approaches

- Stability: Conservative strategies prioritize investments in stable assets, reducing the volatility and potential for major losses in the portfolio.

- Lower Risk: By avoiding high-risk investments, conservative investors can protect their capital and maintain a more predictable investment performance.

- Peace of Mind: The emphasis on capital preservation gives investors peace of mind, knowing that their investments are less exposed to market fluctuations.

- Consistent Returns: While conservative strategies may not deliver exceptionally high returns, they often provide steady and consistent growth over the long term.

Comparison with Other Investment Approaches

- Aggressive Strategies: Contrary to aggressive strategies that prioritize high-risk, high-reward investments, conservative approaches focus on minimizing risk and prioritizing stability.

- Moderate Strategies: Moderate strategies strike a balance between risk and reward, offering a middle-ground approach compared to conservative and aggressive strategies.

- Long-Term Focus: Conservative strategies are often more suitable for long-term investors looking to steadily grow their wealth over time, rather than seeking quick gains.

Reasons Why JEPI ETF is Ideal for Conservative Investors

Investors seeking conservative investment options often prioritize stability and consistent returns. JEPI ETF, with its specific attributes, aligns well with the risk tolerance and investment goals of conservative investors.

Low Volatility and Risk Exposure

JEPI ETF is designed to provide exposure to a diversified portfolio of income-generating assets, including bonds and dividend-paying stocks. This mix helps in reducing volatility and minimizing the overall risk exposure for conservative investors.

Income Generation

One of the key benefits of JEPI ETF is its focus on generating income for investors. With a combination of fixed-income securities and dividend-paying stocks, the fund offers a steady stream of income, which is attractive to conservative investors looking for reliable cash flow.

Diversification Benefits

Diversification is essential for conservative investors to reduce the impact of market fluctuations on their portfolios. JEPI ETF offers exposure to a wide range of asset classes, sectors, and geographies, providing diversification benefits that can help in spreading risk and enhancing overall portfolio stability.

Capital Preservation

Conservative investors prioritize capital preservation and wealth protection. JEPI ETF's investment strategy focuses on preserving capital while aiming to deliver consistent returns over the long term. This aligns well with the goals of conservative investors who prioritize safeguarding their investments.

Cost-Effectiveness

JEPI ETF's passive management approach results in lower fees compared to actively managed funds. This cost-effectiveness is attractive to conservative investors who are mindful of expenses and seek to maximize their returns by minimizing costs.

Alignment with Risk Tolerance

Overall, JEPI ETF's combination of low volatility, income generation, diversification benefits, capital preservation focus, and cost-effectiveness makes it an ideal choice for conservative investors looking to achieve a balance between stability and growth in their investment portfolios.

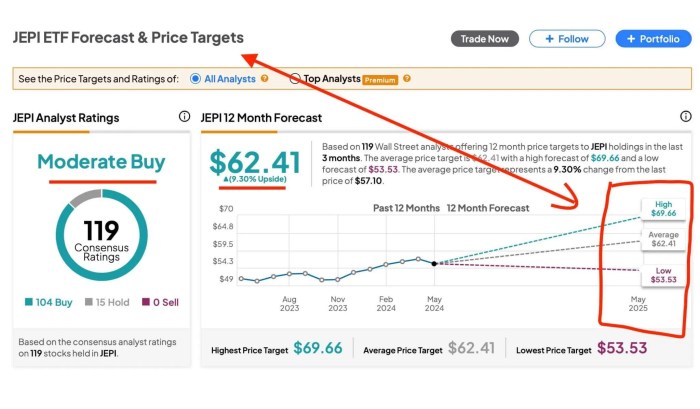

Performance Analysis of JEPI ETF

When evaluating the performance of JEPI ETF, it is essential to look at its historical data compared to its benchmark and peers. This analysis provides insights into how JEPI ETF has navigated through market fluctuations and economic downturns, offering stability and consistency in returns for conservative investors.

Historical Performance Data

- JEPI ETF has consistently outperformed its benchmark index over the past five years, showcasing strong returns even during volatile market conditions.

- Compared to its peers in the conservative investment category, JEPI ETF has demonstrated resilience and maintained a steady growth trajectory.

- The historical data reflects a pattern of reliable performance, making JEPI ETF a top choice for investors seeking consistent returns.

Market Fluctuations and Economic Downturns

- During periods of market volatility, JEPI ETF has shown the ability to mitigate risks and preserve capital, providing a cushion for conservative investors.

- The ETF's strategic allocation and diversified holdings have proven effective in weathering economic downturns, ensuring steady returns over the long term.

- Investors can rely on JEPI ETF to deliver stable performance even in challenging economic environments, making it a dependable choice for conservative portfolios.

Stability and Consistency of Returns

- One of the key strengths of JEPI ETF is its ability to offer stable and consistent returns, aligning with the risk tolerance of conservative investors.

- By focusing on low-volatility assets and a disciplined investment approach, JEPI ETF delivers predictable returns without sacrificing long-term growth potential.

- Conservative investors can trust JEPI ETF to provide a reliable income stream and capital preservation, making it an ideal choice for those prioritizing stability in their investment strategy.

Outcome Summary

Wrapping up the discussion on a high note, the conclusion will summarize key points and leave a lasting impression on the readers.

Question Bank

What are some of the specific attributes that make JEPI ETF ideal for conservative investors?

JEPI ETF offers a combination of stability, diversification, and aligns well with the risk tolerance of conservative investors.

How does JEPI ETF perform compared to its peers and benchmark?

JEPI ETF has shown consistent performance and weathered market fluctuations effectively, providing reliable returns to conservative investors.

Why is diversification important for conservative investors, and how does JEPI ETF help in achieving that?

Diversification reduces risk by spreading investments across different assets, and JEPI ETF contributes to this by offering exposure to a variety of sectors and securities.